Seamless Purchases: Your Guide to Currency Exchange in Toronto

Seamless Purchases: Your Guide to Currency Exchange in Toronto

Blog Article

Discover the Keys to Making Smart Choices in Money Exchange Trading

In the busy world of money exchange trading, the ability to make informed choices can be the distinction in between success and failure. As traders navigate the complexities of the market, they usually look for evasive keys that can offer them an edge. Understanding market fads, executing effective threat management approaches, and assessing the interaction between technical and basic aspects are just a couple of components that add to making clever decisions in this arena. However, there are much deeper layers to check out, consisting of the psychology behind trading choices and the application of sophisticated trading tools. By peeling off back the layers of this detailed landscape, investors might uncover covert insights that might potentially transform their strategy to money exchange trading.

Recognizing Market Trends

An in-depth comprehension of market fads is critical for successful currency exchange trading. Market fads refer to the basic instructions in which the marketplace is relocating over time. By comprehending these patterns, investors can make more educated decisions concerning when to purchase or sell money, eventually maximizing their revenues and minimizing prospective losses.

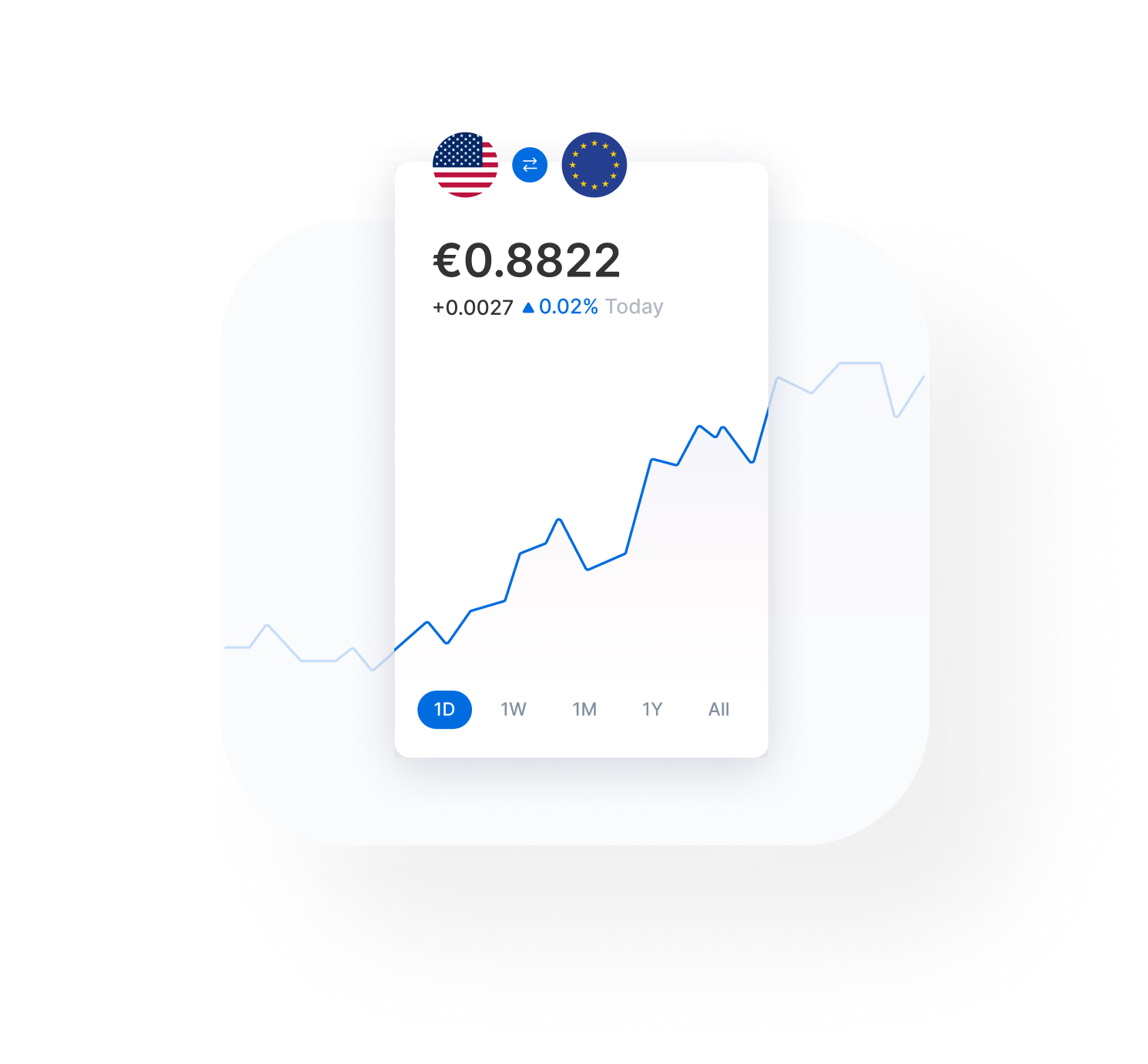

To properly evaluate market fads, traders typically utilize technical analysis, which involves researching historic price graphes and utilizing different indicators to predict future cost movements. currency exchange in toronto. Fundamental evaluation is also crucial, as it entails evaluating economic signs, political events, and other aspects that can influence currency values

Threat Management Methods

Exactly how can money exchange traders efficiently reduce potential dangers while optimizing their financial investment opportunities? Executing durable risk monitoring methods is necessary in the volatile world of money exchange trading. One vital approach is setting stop-loss orders to limit losses in situation the market moves against an investor's placement. By specifying the maximum loss they are willing to birth in advance, traders can shield their funding from significant declines. Additionally, expanding the profile throughout various money pairs can assist spread threat direct exposure. By doing this, an adverse effect on one currency pair may be countered by positive movements in an additional.

In addition, leveraging tools like hedging can further secure investors from unfavorable market motions. Ultimately, a calculated and self-displined strategy to run the risk of management is paramount for long-term success in currency exchange trading.

Essential Vs. Technical Analysis

The discussion between essential and technological evaluation has been continuous in the trading neighborhood. Some investors prefer essential evaluation for its concentrate on macroeconomic factors that drive money values, while others prefer technical evaluation for its focus on cost patterns and patterns. In truth, successful traders commonly use a mix of both approaches to obtain a thorough sight of the marketplace. By incorporating basic and technological analysis, investors can make more informed decisions and improve their total trading performance.

Leveraging Trading Devices

With a solid foundation in technical and essential analysis, currency exchange traders can substantially enhance their decision-making procedure by leveraging various trading devices. One crucial trading device is the financial calendar, her response which aids traders track vital financial events and announcements that could impact money values.

Psychology of Trading

Understanding the psychological facets of trading is essential for money exchange traders to browse the psychological obstacles and prejudices that can affect their decision-making procedure. The psychology of trading looks into the way of thinking of investors, attending to issues such as worry, greed, insolence, and impulsive actions. Emotions can cloud judgment, leading investors to make illogical decisions based upon feelings instead of logic and evaluation. It is important for right here traders to cultivate emotional self-control and preserve a sensible method to trading.

One usual mental catch that investors fall under is confirmation bias, where they seek info that supports their preconceived ideas while disregarding inconsistent proof. This can prevent their capability to adjust to changing market problems and make knowledgeable choices. In addition, the concern of losing out (FOMO) can drive traders to enter trades impulsively, without performing correct study or evaluation.

Verdict

Finally, understanding the art of currency exchange trading needs a deep understanding of market patterns, effective risk management methods, knowledge of technological and basic analysis, usage of trading devices, and understanding of the psychology of trading (currency exchange in toronto). By incorporating these elements, investors can make enlightened decisions and raise their possibilities of success in the unpredictable globe of currency trading

By peeling back the layers of this complex landscape, investors may discover hidden insights that can possibly change their approach to currency exchange trading.

With a solid foundation in fundamental and technological evaluation, money exchange investors can substantially enhance their decision-making process by leveraging different trading tools. One vital trading tool is the economic calendar, which helps investors track important economic events and news that could influence currency worths. By leveraging these trading devices in combination with fundamental and technical evaluation, money exchange investors can make smarter and much more critical trading choices in the vibrant foreign exchange market.

Understanding the psychological aspects go to this web-site of trading is important for money exchange investors to navigate the emotional challenges and predispositions that can impact their decision-making procedure.

Report this page